USAA motorcycle insurance quote is crucial for any rider. This guide dives into the specifics, from understanding key features to obtaining a quote and comparing options. We’ll explore the factors influencing premiums, from rider experience to motorcycle type, and even location. Learn about essential coverage options and discover how to save money on your USAA motorcycle insurance.

Getting the right motorcycle insurance can save you significant money and hassle down the road. We’ll walk you through the process of securing a quote from USAA, providing you with all the necessary information. Plus, we’ll compare USAA’s offerings to other leading providers, empowering you to make an informed decision.

Understanding USAA Motorcycle Insurance

Source: cloudinary.com

USAA motorcycle insurance is specifically designed for members of the US Armed Forces and their families. It offers competitive rates and a range of coverage options tailored to the unique needs of motorcyclists. This overview will detail the key features, coverage types, and policy comparisons to help you understand your options.USAA’s commitment to its members translates into a dedicated approach to motorcycle insurance.

The company understands the specific risks associated with motorcycle riding and provides comprehensive coverage to protect policyholders. This includes tailored options to address varying riding styles and needs.

Key Features and Benefits

USAA motorcycle insurance prioritizes member satisfaction through competitive pricing, a streamlined claims process, and personalized service. This focus on member needs distinguishes USAA from other providers. USAA often offers discounts for safe driving records and other factors.

Coverage Types

USAA offers a variety of coverage options for motorcycle policies. These include, but are not limited to:

- Liability coverage: This protects you if you’re at fault for an accident and cause damage to another person or their property. It typically includes bodily injury liability and property damage liability.

- Collision coverage: This pays for damages to your motorcycle if it’s involved in a collision, regardless of who’s at fault.

- Comprehensive coverage: This provides protection against non-collision damage to your motorcycle, such as theft, vandalism, or weather-related damage.

- Uninsured/Underinsured Motorist coverage: This coverage pays for damages if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured.

- Medical Payments coverage: This pays for medical expenses incurred by you or passengers in the event of an accident, regardless of who’s at fault.

Policy Options

USAA provides a range of motorcycle insurance policy options to meet individual needs.

- Liability-only policies: These policies provide the most basic coverage, primarily focusing on financial responsibility if you’re at fault.

- Comprehensive policies: These include liability, collision, and comprehensive coverage, offering the broadest protection for your motorcycle.

- Customizable options: Many policies can be tailored to add or remove specific coverages, allowing riders to select the best fit for their financial situation and riding habits.

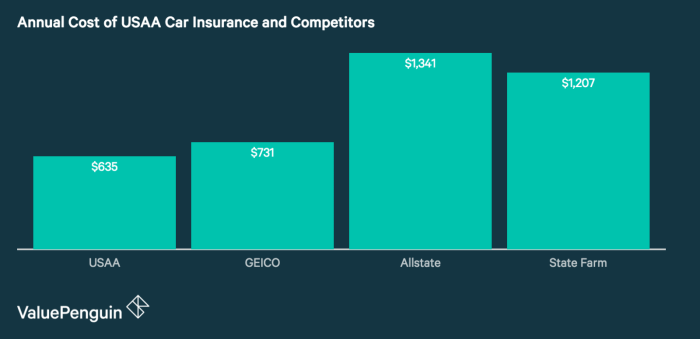

Comparison with Other Providers

USAA motorcycle insurance generally competes favorably with other major providers in the market. Factors like pricing, coverage options, and customer service may vary. It’s advisable to compare quotes from multiple providers to determine the best fit. Direct comparison websites and tools can facilitate this process.

Exclusions and Limitations

Certain activities or situations may not be covered under a USAA motorcycle insurance policy.

- Policy exclusions: These typically include activities such as racing or participating in stunt riding, or use of the motorcycle for illegal purposes.

- Policy limitations: Policy limits are set to cover damages within a specified monetary amount. For example, a liability policy may have limits for bodily injury and property damage.

Claims Process

USAA offers a streamlined claims process for motorcycle accidents. The process often involves reporting the incident, providing necessary documentation, and working with the insurance adjusters.

Factors Affecting Motorcycle Insurance Quotes

Source: money.com

Motorcycle insurance premiums are influenced by a variety of factors, reflecting the unique risks associated with owning and operating a motorcycle. Understanding these factors can help riders anticipate their potential costs and make informed decisions about coverage. This section delves into the key elements that shape motorcycle insurance quotes.Rider experience and history significantly impact insurance premiums. A comprehensive driving record, including accident history, violations, and claims, directly correlates with the risk assessment undertaken by insurance providers.

Motorcyclists with clean records and a proven history of safe riding often qualify for lower premiums.

Rider Experience and History

Rider experience and history are critical components in determining insurance premiums. Insurance companies meticulously evaluate the rider’s driving record, assessing any accidents, traffic violations, or claims. A clean record, demonstrating responsible riding habits, typically translates to lower premiums. Conversely, a history of accidents or violations often results in higher premiums, reflecting the increased risk associated with such incidents.

Motorcycle Type and Model

Motorcycle type and model are significant factors in premium calculations. Different types of motorcycles pose varying degrees of risk. Larger, heavier, and more powerful motorcycles tend to carry a higher risk of accidents, leading to higher insurance costs.

- Cruisers, often featuring large engine displacements and heavier weights, typically incur higher premiums compared to smaller, lighter motorcycles.

- Sport bikes, known for their high performance and maneuverability, may also command higher premiums due to the increased risk of high-speed accidents.

- Touring motorcycles, often equipped with advanced technology and designed for long-distance travel, can also have higher insurance premiums, reflecting the potential for more complex incidents during extended journeys.

Location and Region

Location and region play a substantial role in motorcycle insurance costs. Areas with higher accident rates, such as those with more congested roads or challenging weather conditions, often experience higher insurance premiums.

- Urban areas with dense traffic and limited visibility often have higher insurance premiums than rural areas.

- Regions with frequent inclement weather, such as those prone to heavy rain or severe storms, might have higher premiums to reflect the increased risk associated with adverse conditions.

Add-on Coverage Options

Add-on coverage options significantly influence motorcycle insurance premiums. Coverage for specific needs, such as comprehensive protection, collision coverage, or uninsured/underinsured motorist protection, can all increase the overall cost of the policy.

- Collision coverage, protecting against damage to the motorcycle in an accident, can raise premiums.

- Comprehensive coverage, safeguarding against non-collision damage, such as theft or vandalism, can also elevate premiums.

- Uninsured/underinsured motorist protection, ensuring coverage in the event of an accident involving an at-fault driver without adequate insurance, is another factor that can increase premium costs.

Obtaining a USAA Motorcycle Insurance Quote

Source: usaa.com

Securing a USAA motorcycle insurance quote is a straightforward process, designed to be efficient and user-friendly. This guide provides a step-by-step approach, detailing the necessary information and comparison strategies to ensure you find the best coverage for your needs.Obtaining a tailored quote is crucial to understanding the cost and coverage associated with USAA motorcycle insurance. By following the Artikeld steps, you can compare various options and select the plan that best aligns with your financial and riding preferences.

Step-by-Step Procedure for Obtaining a Quote

This structured process will guide you through the steps to obtain a USAA motorcycle insurance quote.

- Access the USAA website or mobile app. This direct access provides convenient and rapid access to the quoting tools.

- Provide the required vehicle details. This includes the year, make, model, and Vehicle Identification Number (VIN) of your motorcycle.

- Enter your personal information. This encompasses your age, address, and driving history.

- Specify your desired coverage options. Select liability limits and any additional coverage options, such as collision coverage.

- Review and submit the quote. Carefully review the proposed coverage and premiums to ensure it aligns with your needs. Submitting the quote finalizes the request.

Necessary Information for Quoting

A complete quote requires specific details about your motorcycle, rider, and coverage preferences. The table below Artikels the necessary data points.

| Category | Details |

|---|---|

| Motorcycle Information | Year, Make, Model, VIN |

| Rider Information | Age, Address, Driving History (including any accidents or violations) |

| Coverage Preferences | Liability Limits (e.g., $100,000, $300,000), Collision Coverage (optional), Uninsured Motorist Coverage (optional) |

Comparing Quotes from Different Providers

Once you’ve received a USAA quote, comparing it to other providers is essential to finding the best value. Consider factors beyond just the premium, such as the specific coverage options offered.A thorough comparison table, like the one below, allows you to quickly assess different insurance options side-by-side. This facilitates a more informed decision-making process.

| Provider | Premium | Coverage |

|---|---|---|

| USAA | $1,200 | Liability: $300,000; Collision: Included; Uninsured Motorist: Included |

| Other Company A | $1,500 | Liability: $250,000; Collision: Included; Uninsured Motorist: Included |

| Other Company B | $1,000 | Liability: $100,000; Collision: Optional; Uninsured Motorist: Optional |

Motorcycle Insurance Options and Considerations

Source: cloudinary.com

Choosing the right motorcycle insurance coverage is crucial for protecting your investment and financial well-being. Understanding the various options available, including add-on coverages, policy terms, and the benefits of different coverage levels, empowers you to make informed decisions that align with your needs and budget. A comprehensive approach to insurance planning can help you avoid costly surprises down the road.Beyond the basic liability coverage, numerous add-on options can enhance your policy, providing greater protection.

These extras, while often increasing your premium, can provide peace of mind and financial security in the event of an accident or unforeseen circumstances. Careful consideration of these options is essential to building a policy that best suits your individual requirements.

Motorcycle Insurance Add-on Coverages

Understanding the different add-on coverages is key to selecting a policy that offers adequate protection. These optional coverages extend beyond the fundamental liability requirements, offering extra layers of security.

| Coverage | Description | Premium Impact |

|---|---|---|

| Uninsured Motorist | Covers damages if you are involved in an accident with a driver who doesn’t have insurance. | Generally increases premium. The extent of the increase depends on the policy limits and specific circumstances. |

| Collision | Covers damages to your motorcycle if it’s involved in an accident, regardless of who is at fault. | Usually increases premium, the extent of the increase is influenced by policy limits. |

| Comprehensive | Covers damages to your motorcycle from events other than collisions, such as theft, vandalism, or weather damage. | Generally increases premium, the increase is usually less significant than for Collision coverage. |

| Medical Payments | Covers medical expenses for you and your passengers involved in an accident, regardless of fault. | Can increase premium. |

| Personal Injury Protection (PIP) | Covers medical expenses for you and your passengers involved in an accident, regardless of fault, in states where this coverage is available. | Increases premium, the increase varies depending on the policy’s specific terms. |

Understanding Policy Terms and Conditions

Thorough review of the policy terms and conditions is vital. This involves understanding the exclusions, limitations, and specific details of the coverage. Pay close attention to the definition of “at-fault” in the event of an accident, and the associated limits and coverage levels. Carefully examining these details ensures you understand the full scope of your coverage and what’s not covered.

This helps prevent misunderstandings or unexpected gaps in protection.

Comprehensive Coverage vs. Liability-Only Coverage

Choosing between comprehensive and liability-only coverage requires careful consideration of your financial situation and risk tolerance. Comprehensive coverage provides more extensive protection by covering damages to your motorcycle from various events, even if you’re not at fault. Liability-only coverage, on the other hand, only covers damages you cause to others. The premium difference reflects the added protection offered by comprehensive coverage.

The choice often depends on your willingness to assume financial responsibility for incidents beyond your control.

Modifying or Updating an Existing USAA Motorcycle Policy

USAA allows policy modifications and updates. This involves contacting USAA customer service to discuss desired changes. They will guide you through the process of adjusting your existing policy to align with your evolving needs or circumstances. Modifying existing coverage may include adjusting coverage limits, adding or removing coverages, or making other policy changes.

Tips for Saving Money on USAA Motorcycle Insurance: Usaa Motorcycle Insurance Quote

Source: quote.com

USAA motorcycle insurance offers competitive rates, but savvy strategies can further reduce your premiums. Understanding the factors influencing your quote and implementing cost-saving measures can significantly impact your monthly payments. This section details key strategies for optimizing your coverage while minimizing unnecessary costs.Motorcycle insurance premiums are influenced by several factors, including your driving history, the type of motorcycle, and the coverage selected.

Proactive measures, such as maintaining a clean driving record and selecting appropriate coverage, can lead to substantial savings. Applying these tips can help you secure the best possible rate for your USAA motorcycle policy.

Safe Riding Practices and Premium Reduction

Safe riding practices directly correlate with lower premiums. Consistent adherence to traffic laws and safe riding techniques can demonstrate responsible behavior, leading to reduced risk and potentially lower premiums. For instance, avoiding aggressive maneuvers and maintaining a safe following distance can help prevent accidents, which in turn, can positively influence your insurance rates.

Discounts Offered by USAA for Motorcycle Insurance

USAA often provides discounts for motorcycle insurance, which can be a significant cost-saver. These discounts may vary depending on individual circumstances, but some common discounts include those for safe driving, defensive driving courses, and multiple vehicles. Enrolling in a defensive driving course is a tangible step to improve your driving skills and could result in a discounted premium.

The Impact of a Clean Driving Record, Usaa motorcycle insurance quote

A clean driving record is a significant factor in determining motorcycle insurance premiums. Insurance companies assess risk based on driving history. A clean record demonstrates responsible driving behavior, reducing the perceived risk and potentially resulting in a lower premium. For example, drivers with traffic violations or accidents might face higher premiums due to the increased risk associated with their past driving performance.

Optimizing Coverage for Cost-Effectiveness

Choosing the right coverage level is crucial for cost-effectiveness. Comprehensive coverage often comes at a higher cost, but it provides greater protection in the event of damage or theft. Understanding the coverage options available, considering the value of your motorcycle, and the potential risks you face is vital for optimizing coverage without unnecessary costs. A thorough review of your coverage needs and a comparison of different policy options can help you choose the right level of protection at a price that suits your budget.

Strategies for Lowering Motorcycle Insurance Premiums

Implementing several strategies can lower your motorcycle insurance premiums. These strategies include:

- Maintaining a clean driving record: Avoiding traffic violations and accidents is essential for maintaining a low premium.

- Enrolling in a defensive driving course: Participating in a defensive driving course can demonstrate your commitment to safe riding and might qualify for a discount.

- Increasing your deductible: A higher deductible can reduce your premium, but be prepared to pay a larger amount if you file a claim.

- Considering gap insurance: If you’re financing your motorcycle, consider gap insurance, which covers the difference between the actual cash value and the outstanding loan balance.

Illustrative Examples and Scenarios

Understanding USAA motorcycle insurance involves more than just the basics. Real-world examples help illustrate how different factors interact to impact premiums and claims processes. These examples showcase the nuances of motorcycle insurance and highlight the importance of careful consideration of policy options.

Impact of Riding Experience on Premiums

Motorcycle insurance premiums are often influenced by the rider’s experience. A novice rider, with fewer years of experience and potentially a higher accident risk, will generally pay a higher premium than an experienced rider. A new rider, perhaps just graduating to a motorcycle, might have a significantly higher premium than a seasoned motorcyclist with a strong safety record.

Factors such as the rider’s history of traffic violations or accidents also play a crucial role in determining the premium. A clean driving record, with no accidents or violations, often results in lower premiums.

Claims Process Illustrations

Claims processes can vary depending on the specific incident and the policy’s details. A scenario involving a minor fender bender, resulting in minimal damage to both vehicles, would likely have a straightforward and quick claims process. Conversely, a serious accident with significant property damage or injuries could necessitate a more extensive and time-consuming claims process, potentially involving medical evaluations and detailed accident reports.

The claims process is a crucial aspect of any insurance policy and understanding the steps involved is important for any policyholder.

Policy Options and Their Advantages/Disadvantages

Different policy options offer various benefits and drawbacks. A comprehensive policy with high liability limits might provide extensive coverage in the event of an accident, but it may come at a higher premium. A basic policy, while potentially less expensive, might offer limited coverage, potentially leaving the policyholder exposed to financial risks. A policy with add-on coverages such as roadside assistance or rental car coverage can be advantageous in specific circumstances.

A rider with a longer commute, for example, might find roadside assistance invaluable.

Examples of Coverage Benefits

Specific coverage options can prove beneficial in various situations. Collision coverage protects against damage to the motorcycle in an accident, regardless of who is at fault. This coverage is crucial if the policyholder’s motorcycle is involved in an accident where the other party is at fault. Liability coverage protects against financial responsibility for injuries or damages caused to others.

This coverage is essential for legal and financial protection if the policyholder is deemed responsible for an accident. Understanding the specific circumstances in which these coverages apply is vital.

Illustrative Scenarios and Premium Impacts

Consider these illustrative scenarios to understand how factors impact premiums:

- A young rider with a limited driving history and a high-performance motorcycle will likely pay a higher premium compared to an experienced rider with a standard motorcycle.

- A rider living in a high-accident area may experience higher premiums than a rider living in a safer area.

- Adding comprehensive coverage to a policy will increase the premium, but it offers broader protection against damage to the motorcycle.

- A rider who takes a motorcycle safety course and demonstrates safe riding practices may qualify for a premium discount.

Thoroughly reviewing the policy documents and understanding the terms and conditions is crucial for informed decision-making. Policy language can be complex; seeking clarification from USAA representatives is a valuable step. This understanding is essential for making informed choices about coverage and premiums.

Last Point

In conclusion, securing a USAA motorcycle insurance quote is a straightforward process once you understand the key elements. By considering your specific needs and comparing quotes, you can choose the policy that best protects you and your investment. Remember to review the policy terms carefully and consider add-on coverages. Ultimately, your choice will depend on your individual circumstances and risk tolerance.

FAQ Compilation

What are the typical exclusions and limitations in USAA motorcycle insurance?

Exclusions often include coverage for pre-existing conditions or damage from certain types of events. Review the policy document for complete details.

How does my location impact my motorcycle insurance costs?

High-risk areas with a higher frequency of accidents tend to have higher premiums. USAA considers location data in setting rates.

What discounts does USAA offer for motorcycle insurance?

USAA often offers discounts for safe riding practices, clean driving records, and bundled insurance products. Check their website for current offers.

What is the claims process for USAA motorcycle insurance?

The claims process typically involves reporting the incident, gathering necessary documentation, and cooperating with USAA’s claims adjusters. Detailed information is provided in your policy.