South carolina workmans comp insurance – South Carolina workers’ comp insurance is a crucial aspect of workplace safety and employee protection. Navigating the system can be complex, involving various coverage types, employer responsibilities, and claim processes. Understanding these nuances is key to ensuring both employers and employees are well-informed and protected under the law.

This guide delves into the intricacies of South Carolina workers’ compensation, providing a detailed overview of the system, its coverage details, employer responsibilities, the claim process, costs, and available resources. It also compares South Carolina’s system to others, offering valuable context.

Overview of South Carolina Workers’ Compensation Insurance

South Carolina’s workers’ compensation system is designed to provide benefits to employees injured on the job. It’s a crucial safety net, ensuring that injured workers receive medical care and financial support while they recover. This system is governed by state law and administered by a dedicated agency.The system aims to balance the needs of injured workers with the economic realities of employers.

This balance is often reflected in the specific coverage amounts and eligibility criteria. Key features of South Carolina’s workers’ compensation system include the emphasis on prompt and fair compensation for injured workers, while also maintaining the viability of businesses within the state.

Key Features and Characteristics

South Carolina’s workers’ compensation insurance program is structured to provide a comprehensive framework for managing workplace injuries. This framework includes a variety of features, including mandatory coverage for employers, specific eligibility requirements, and established claim processes. It’s crucial for both employees and employers to understand these key aspects.

Types of Coverage Offered

The insurance typically covers medical expenses, lost wages, and rehabilitation services. Specific benefits vary depending on the nature and extent of the injury. This comprehensive coverage is essential for ensuring the well-being of injured workers and supporting their return to health and productivity.

Eligibility Requirements for Claims

To be eligible for workers’ compensation benefits in South Carolina, an employee must meet certain criteria. These criteria typically involve proving that the injury occurred in the course of employment and was not solely caused by the employee’s own negligence. A significant aspect of eligibility involves the employee’s status as a legally defined employee, and not an independent contractor.

Documentation and evidence are critical for determining eligibility.

Comparison to Other States

| State | Coverage Averages | Eligibility Criteria | Claim Process |

|---|---|---|---|

| South Carolina | Average weekly benefits: $350-$450 (based on pre-2023 data). Average cost of premiums: Dependent on industry, payroll size, and safety record. Note: Data is illustrative and may vary. Always consult official sources for the most up-to-date information. |

Injury must arise out of and in the course of employment. Employee must be considered an employee under South Carolina law, not an independent contractor. Employee must not be solely responsible for the injury due to negligence. | Claims are filed with the South Carolina Department of Workers’ Compensation. The process involves reporting the injury, obtaining medical treatment, and submitting necessary documentation. |

| California | Average weekly benefits: $700-$

800. Average cost of premiums Significantly higher than South Carolina, due to broader coverage and mandated benefits. |

Injury must occur in the course and scope of employment. Employees are often eligible regardless of the degree of their contribution to the accident, but there are exceptions. | Claims are filed with the California Division of Workers’ Compensation. The process is often more complex, involving specific forms and procedures. |

Coverage Details

Source: mdswlegal.com

South Carolina’s workers’ compensation system aims to provide a safety net for employees injured or suffering illness due to their employment. This section details the types of benefits available, the amounts and durations, and the procedures for filing claims. Understanding these aspects is crucial for employees and employers alike.South Carolina workers’ compensation laws cover a wide array of injuries and illnesses, ensuring a level of protection for those affected.

This coverage extends to both accidental injuries and occupational diseases. Procedures are established for filing claims, and eligibility criteria are defined for each benefit type.

Types of Benefits

Workers’ compensation benefits in South Carolina encompass various categories, each with specific provisions. These benefits are designed to address the financial and medical needs of injured workers.

- Medical Expenses: This component of workers’ compensation covers the costs of necessary medical treatment for work-related injuries or illnesses. This includes doctor visits, hospitalizations, surgeries, physical therapy, and other medically necessary services. The coverage typically continues until the injury or illness is resolved, and the worker reaches maximum medical improvement (MMI).

- Lost Wages: For time off work due to an injury or illness, lost wages benefits can provide partial replacement of income. These benefits are generally calculated based on the worker’s average weekly wage. The duration of lost wage benefits is typically tied to the period of temporary or permanent disability, as determined by the medical evidence.

- Permanent Disability Benefits: In cases of permanent impairments resulting from work-related injuries or illnesses, workers may be eligible for permanent disability benefits. These benefits can be structured as a lump sum payment or a continuing payment, depending on the circumstances and severity of the disability. The amount of the benefit depends on the degree of disability and the worker’s pre-injury earnings.

- Death Benefits: If a work-related injury or illness results in the death of an employee, the dependents of the deceased worker may be eligible for death benefits. These benefits usually cover funeral expenses and provide financial support for surviving family members.

Benefit Amounts and Duration

The specific amounts and durations of benefits vary depending on the circumstances of each case. These factors include the severity of the injury or illness, the employee’s pre-injury earnings, and the length of recovery.

- Medical Expenses: Medical expenses are typically covered until the injured worker reaches maximum medical improvement (MMI). The specific amounts depend on the costs of treatment, and there are usually no caps on the amount of coverage for necessary medical treatment. It’s important to note that these benefits are not limitless and are subject to the rules and regulations established in South Carolina.

- Lost Wages: Lost wages benefits usually replace a percentage of the worker’s average weekly wage, typically 60%. The duration of benefits depends on the worker’s recovery period, with maximum periods often set by state law.

Filing a Claim

The procedure for filing a workers’ compensation claim is established in South Carolina law. Following these procedures is crucial for ensuring a smooth and efficient claim process.

- Initial Steps: The injured worker should immediately notify their employer of the injury or illness. Documentation, such as medical records, is critical. The worker should also contact the appropriate workers’ compensation agency as soon as possible to begin the claim process. The agency will guide the worker through the required documentation and procedures.

- Evidence Gathering: The injured worker should gather all relevant medical documentation, including doctor’s reports, treatment records, and any other evidence supporting their claim. This evidence will be essential in determining the extent of the injury or illness and eligibility for benefits.

- Claim Resolution: The workers’ compensation agency will review the claim, potentially leading to an agreement or further investigation. A hearing or mediation may be necessary to resolve disputes.

Covered Injuries and Illnesses

South Carolina workers’ compensation covers a broad range of injuries and illnesses. Accidents arising from the course of employment are typically covered, along with occupational diseases.

- Accidents: Injuries sustained during work activities, such as slips, trips, falls, or machinery accidents, are commonly covered. The key is that the accident arose out of and in the course of employment.

- Occupational Diseases: Illnesses linked to specific work conditions, such as repetitive stress injuries, exposure to hazardous materials, or certain types of cancers, are also covered under specific conditions Artikeld in South Carolina law.

Summary of Benefits

| Type of Benefit | Description | Amount/Duration | Eligibility Criteria |

|---|---|---|---|

| Medical Expenses | Covers necessary medical treatment for work-related injuries/illnesses. | Until maximum medical improvement (MMI); dependent on treatment costs. | Injury/illness must be work-related. |

| Lost Wages | Replaces a portion of lost income due to work-related injuries/illnesses. | Typically 60% of average weekly wage, with a maximum duration. | Injury/illness must be work-related; must be unable to work. |

| Permanent Disability | Benefits for permanent impairments from work-related injuries/illnesses. | Varying amounts and durations based on impairment level and pre-injury earnings. | Permanent impairment resulting from work-related injury/illness. |

| Death Benefits | Financial support for dependents of deceased workers due to work-related injuries/illnesses. | Depends on the specifics of the death and state laws. | Death must be work-related. |

Employer Responsibilities

South Carolina employers have a crucial role in ensuring the safety and well-being of their employees. A key part of this responsibility is providing workers’ compensation insurance. Understanding these obligations is essential for both legal compliance and maintaining a safe work environment.Employers are legally obligated to provide workers’ compensation coverage for their employees. This coverage is designed to protect employees injured on the job and help them recover financially.

Failure to comply with these obligations can result in serious legal and financial consequences.

Legal Requirements for Coverage

South Carolina law mandates that employers provide workers’ compensation insurance for their employees. This requirement applies to nearly all employers, with some limited exceptions, like very small businesses or those in specific industries. Failure to obtain the necessary coverage can result in significant penalties. Employers should consult with legal professionals or workers’ compensation insurance providers to confirm compliance with the current regulations.

Maintaining Accurate Records

Maintaining accurate records of work-related injuries is critical for both employers and employees. These records help determine the legitimacy of claims and ensure that injured workers receive appropriate compensation. Thorough documentation of incidents, including witness statements, medical reports, and return-to-work plans, is essential. Such documentation also helps to prevent fraudulent claims and ensure that all involved parties are treated fairly.

Employers should ensure that all documentation is accurate, complete, and readily available for review by the workers’ compensation system.

Potential Penalties for Non-Compliance, South carolina workmans comp insurance

Non-compliance with workers’ compensation laws can lead to significant penalties. These penalties can include fines, legal fees, and potential criminal charges. Furthermore, non-compliance can damage an employer’s reputation and lead to a negative perception of the company among employees and the wider community. Employers should prioritize compliance with workers’ compensation laws to avoid such penalties and maintain a positive working environment.

Summary of Employer Responsibilities in South Carolina

Employers in South Carolina are legally obligated to provide workers’ compensation insurance for their employees. This includes maintaining accurate records of work-related injuries, promptly reporting such incidents, and ensuring that injured workers receive appropriate medical treatment and compensation. Non-compliance can lead to significant penalties, so careful adherence to the law is crucial.

Claim Process and Procedures: South Carolina Workmans Comp Insurance

Source: steinberglawfirm.com

Navigating the workers’ compensation claim process in South Carolina can feel complex. Understanding the steps involved, required documentation, and the roles of each party involved can significantly ease the process. This section provides a comprehensive overview to help employees and employers alike.

Filing a Claim

The first step in the workers’ compensation process is filing a claim. Employees must report their injury to their employer as soon as possible, typically within 30 days. The employer should then promptly report the injury to the insurer. Formally initiating the claim involves completing the necessary forms, which will be provided by the insurer. These forms typically include details about the injury, the date of the incident, and the employee’s medical history.

Required Documentation and Forms

A crucial aspect of the claim process is the collection and submission of appropriate documentation. This often includes medical records from treating physicians, details of lost wages, and any supporting evidence. Examples of forms that might be required include a Notice of Injury form, a detailed report from the treating physician, and proof of lost wages. The specific forms required may vary depending on the circumstances of the claim.

A thorough understanding of the forms and their specific requirements is essential.

Roles of Insurer, Employer, and Employee

The claim process involves collaboration among the insurer, employer, and employee. The insurer is responsible for processing the claim, investigating the injury, and determining the appropriate benefits. The employer’s role includes promptly reporting the injury, providing necessary information, and cooperating with the insurer’s investigation. The employee’s role is to cooperate with the insurer and employer in providing necessary documentation, and to actively participate in the claim’s progression.

Each party has distinct responsibilities that need to be fulfilled to ensure a smooth claim process.

Dispute Resolution

Disputes can arise during the claim process, concerning issues such as the extent of the injury, the amount of benefits, or the responsibility for the accident. If a dispute arises, the insurer and employee will usually attempt to resolve the dispute through informal means of negotiation and mediation. If the informal resolution fails, formal dispute resolution procedures, such as an administrative hearing, may be necessary.

The specific procedures for dispute resolution are Artikeld in the state’s workers’ compensation laws. Understanding these processes is key to resolving disputes efficiently.

Claim Process Flowchart

[Illustrative Flowchart Description: A flowchart would visually represent the claim process, starting with the employee reporting the injury to their employer. Key steps, such as completing forms, providing medical documentation, and insurer evaluation, would be clearly shown. The flowchart would also illustrate potential dispute resolution paths. Branches of the flowchart would indicate the possible outcomes, such as claim approval, denial, or need for further investigation.

The flow would continue until the claim is resolved. For example, a denial might lead to an appeal, which would be depicted in the flowchart.]

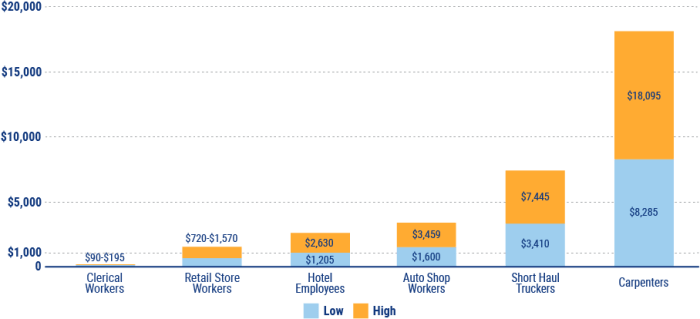

Cost and Premiums

Source: kc-usercontent.com

The cost of workers’ compensation insurance in South Carolina is influenced by a complex interplay of factors. Understanding these factors is crucial for employers to effectively manage their insurance costs and maintain a safe workplace. Premiums are not static; they fluctuate based on various risk factors, and proactive safety measures can significantly reduce these costs.The premiums paid by South Carolina employers for workers’ compensation insurance are not uniform.

Variations in the cost reflect the specific risks associated with different industries and individual businesses. Careful assessment of these risks, coupled with effective safety programs, is vital for minimizing premiums and promoting a safe work environment.

Factors Influencing Workers’ Compensation Premiums

Several key factors significantly impact the premium rates employers pay. These factors are meticulously considered by insurance companies to assess the likelihood of claims.

- Industry Classification:

- Certain industries, by their inherent nature, carry a higher risk of work-related injuries. For instance, construction and manufacturing frequently involve heavy machinery and potentially hazardous tasks, leading to a higher probability of claims and consequently, higher premiums.

- Payroll Size and Composition:

- Larger companies with more employees often face higher premiums, as the pool of potential claims is larger. Additionally, the specific job roles and skills of employees also play a significant role. A workforce with a higher concentration of physically demanding roles might lead to a higher risk profile, resulting in higher premiums.

- Safety Record and Compliance:

- Businesses with a history of workplace safety incidents or non-compliance with safety regulations are more likely to have higher premiums. Conversely, companies demonstrating a strong safety record and adherence to best practices are rewarded with reduced premiums. These factors directly correlate with the company’s claim frequency and severity.

- Geographic Location:

- Variations in accident rates across different geographic areas can also affect premium costs. Factors like weather conditions, specific environmental hazards, and local regulations may contribute to regional variations in premiums.

Risk Factors and Premium Impact

The risk of injury is a direct determinant of workers’ compensation premiums. The frequency and severity of injuries directly influence the premium structure.

- Frequency of Injuries:

- Companies experiencing a higher rate of workplace injuries will likely face higher premiums. This is because the frequency of injuries directly correlates with the expected cost of claims. A proactive approach to safety and accident prevention is crucial to lowering this frequency.

- Severity of Injuries:

- The severity of injuries also significantly impacts premiums. More severe injuries often lead to prolonged recovery periods and substantial medical expenses. Consequently, the insurance company will incorporate these factors into the premium calculation.

Premium Structures

South Carolina offers different premium structures to accommodate various business needs and risk profiles.

- Manual Premium:

- This structure utilizes statistical data to assess the risk profile of each business. This data encompasses various factors, including industry classification, safety records, and the frequency and severity of injuries. The premium calculation is based on a formula that accounts for historical claims data.

- Experience Modification Factor (EMF):

- The EMF is a crucial component in the premium calculation. It adjusts the premium based on a company’s historical claims experience. A low EMF indicates a good safety record, resulting in lower premiums. Conversely, a high EMF suggests a higher-than-average claim rate, resulting in higher premiums.

Cost Reduction Strategies

Employers can implement various strategies to reduce their workers’ compensation costs and improve their safety record.

- Implement Comprehensive Safety Programs:

- A robust safety program, including regular training, hazard assessments, and incident reporting, is critical for reducing workplace accidents. This will help prevent injuries and improve the safety record, leading to lower premiums.

- Maintain Compliance with Regulations:

- Adhering to all relevant safety regulations is essential. Compliance demonstrates a commitment to safety and often results in favorable premium rates.

- Promote a Safety Culture:

- Foster a work environment that prioritizes safety. Employee participation and engagement in safety initiatives are critical to the success of any safety program.

Insurance Provider Comparison

Direct comparisons of insurance providers are complex. Different companies might have varying approaches to rating risks. Therefore, direct premium comparisons should be viewed cautiously.

Resources and Support

Navigating the workers’ compensation system can be complex, especially during a challenging time. This section Artikels valuable resources available to both workers and employers in South Carolina to ensure a smoother process and a better understanding of their rights and responsibilities. Knowing where to turn for assistance can make a significant difference in resolving issues effectively.Understanding the various support systems and legal avenues available empowers individuals to make informed decisions and seek the appropriate help when needed.

Key Resources for Workers and Employers

South Carolina provides a range of resources to aid workers and employers in their interactions with the workers’ compensation system. These resources encompass government agencies, legal aid organizations, and advocacy groups, offering support and guidance at different stages of the process. Utilizing these resources can expedite the resolution of claims and disputes.

- Government Agencies: The South Carolina Department of Labor, Licensing, and Regulation (SC DLR) is the primary state agency responsible for administering workers’ compensation. Their website provides essential information, claim procedures, and contact details. The agency is equipped to handle inquiries, resolve disputes, and assist both employers and employees in navigating the system.

- Legal Aid Organizations: Several legal aid organizations specialize in workers’ compensation cases. These organizations offer legal representation and guidance to those who may be struggling to afford legal counsel. These organizations provide a critical service, especially for workers who may not be able to afford legal representation. Their expertise can significantly benefit those seeking fair compensation and resolution.

- Advocacy Groups: Advocacy groups often provide crucial support and representation to workers in workers’ compensation cases. These groups advocate for fair treatment and improved worker protections within the system. They often offer resources, information, and support networks to those affected by work-related injuries or illnesses.

Finding Legal Representation

Seeking legal representation is often a critical step in workers’ compensation cases, especially when facing complex issues or disputes. The process of finding legal representation can vary depending on individual circumstances.

- Researching Attorneys: Researching attorneys specializing in workers’ compensation law is a crucial first step. Look for attorneys with experience in handling similar cases and a proven track record of success.

- Seeking Recommendations: Recommendations from trusted sources, such as other workers, friends, or colleagues, can be invaluable. Word-of-mouth recommendations can help identify reputable attorneys who have a good understanding of the system.

- Evaluating Qualifications: Thoroughly review an attorney’s qualifications, experience, and success rate in workers’ compensation cases. Attorneys with a proven track record are more likely to provide effective representation.

State Websites and Contact Information

| Category | Resource | Description | Contact Info |

|---|---|---|---|

| Government Agencies | South Carolina Department of Labor, Licensing, and Regulation (SC DLR) | The primary state agency responsible for administering workers’ compensation. | (Insert website link here) (Insert phone number here) |

| Legal Aid Organizations | (Insert link to relevant legal aid organization) | (Insert description of legal aid organization) | (Insert contact information here) |

| Advocacy Groups | (Insert link to relevant advocacy group) | (Insert description of advocacy group) | (Insert contact information here) |

Closing Summary

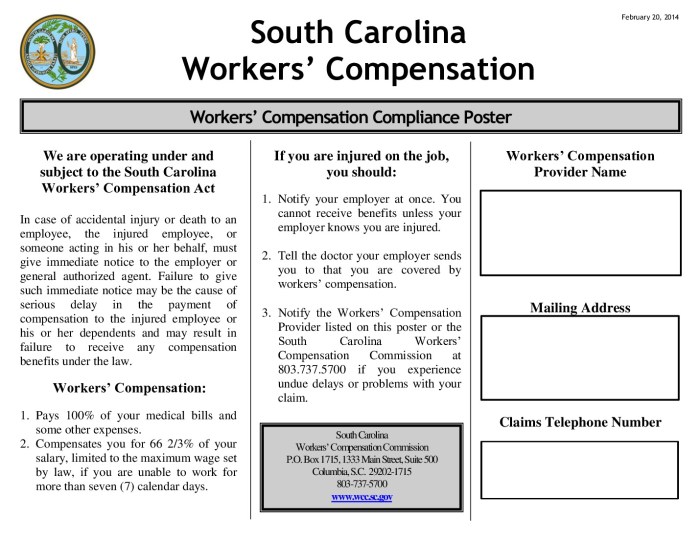

Source: laborposters.org

In conclusion, South Carolina’s workers’ compensation system, while complex, is designed to provide crucial support to injured workers and to hold employers accountable. This guide has explored the various facets of this system, from coverage details and employer obligations to the claim process and available resources. By understanding these elements, both employers and employees can better protect their rights and navigate the system effectively.

Common Queries

What are the typical costs of premiums for workers’ compensation insurance in South Carolina?

Premiums vary greatly depending on factors such as the industry, the company’s safety record, and the types of jobs performed. Detailed information about average premiums is provided in the “Cost and Premiums” section of this guide.

What types of injuries are typically covered under South Carolina workers’ compensation?

South Carolina workers’ compensation generally covers injuries and illnesses that arise out of and in the course of employment. This includes both physical and mental health issues stemming from work-related causes. Specific details on coverage are provided in the “Coverage Details” section.

How long does the claim process typically take in South Carolina?

The claim process timeline can vary significantly based on the complexity of the case and the efficiency of all parties involved. This process is discussed in detail within the “Claim Process and Procedures” section.

What resources are available to help employees understand their rights and navigate the claim process?

The “Resources and Support” section details a range of resources, including government agencies, legal aid organizations, and relevant state websites, to assist workers in South Carolina with their claims.