Maryland auto insurance quotes are crucial for drivers in the state. This guide provides a comprehensive overview of the Maryland auto insurance market, exploring various coverage options and factors affecting premiums. Understanding the nuances of these quotes can help you make informed decisions and secure the best possible rates. We’ll delve into the different types of insurance available, examine the role of insurance providers, and guide you through the process of comparing quotes.

The market is quite competitive, with various providers offering a range of services and benefits. We’ll analyze factors like driving records, vehicle types, and location, highlighting how they impact insurance premiums. Our goal is to equip you with the knowledge necessary to navigate the quote process effectively, minimizing potential pitfalls and maximizing your savings.

Understanding Maryland Auto Insurance

Source: 4autoinsurancequote.com

Maryland’s auto insurance market is a complex system designed to protect drivers and their assets. Navigating the various coverage options and understanding the factors influencing premiums is crucial for making informed decisions. The state’s regulations and insurance companies play a significant role in shaping this market.Maryland’s auto insurance market operates within a framework established by state regulations. These regulations aim to ensure a balance between reasonable premiums and adequate coverage for drivers and other road users.

This system is built upon a variety of coverages, ensuring financial security for all parties involved in a car accident.

Types of Auto Insurance Coverage

Understanding the different types of coverage available is vital for selecting the appropriate policy. Maryland offers several essential coverages, providing comprehensive protection for drivers and their vehicles.

- Liability Coverage: This coverage protects you financially if you’re at fault for an accident, covering damages to the other party’s vehicle and injuries they sustain.

- Collision Coverage: This coverage pays for damages to your vehicle regardless of who is at fault in an accident. For example, if you collide with another vehicle, this coverage will compensate for the damage to your car, regardless of whether you were responsible for the accident.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as vandalism, theft, or weather events. For instance, if your car is damaged by a falling tree during a storm, comprehensive coverage will cover the repairs.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in if you’re involved in an accident with a driver who lacks or has insufficient insurance. It safeguards you from financial responsibility when the at-fault party does not have adequate insurance.

Factors Influencing Auto Insurance Premiums

Numerous factors influence the cost of your auto insurance policy in Maryland. These factors are often considered by insurance companies to calculate premiums.

- Driving Record: A clean driving record, free from accidents and traffic violations, usually results in lower premiums. Conversely, a history of accidents or violations will typically lead to higher premiums. For example, a driver with multiple speeding tickets is likely to have a higher premium than a driver with a clean record.

- Vehicle Type: The type of vehicle you drive plays a role in your premium. Sports cars or high-performance vehicles often come with higher premiums due to their increased risk of damage. The value of the vehicle is also a factor, with higher-value vehicles having potentially higher premiums.

- Location: Your location within Maryland can affect your premium. Areas with higher accident rates or higher theft rates typically have higher premiums. For example, a rural area might have lower premiums than a densely populated urban area.

- Age and Gender: Age and gender are also factors. Younger drivers are generally considered higher risk and typically pay higher premiums, while older drivers often have lower premiums.

Role of Insurance Companies in the Maryland Market

Insurance companies play a critical role in providing coverage and setting premiums in the Maryland market. They assess risks, calculate premiums, and provide financial protection to policyholders.

- Risk Assessment: Insurance companies analyze factors like driving history, vehicle type, and location to assess the risk associated with insuring a particular driver.

- Premium Calculation: Based on their risk assessment, companies calculate premiums that reflect the level of risk. This is a complex process considering numerous factors.

- Financial Protection: Insurance companies provide financial protection to policyholders in the event of an accident or other covered incident.

Comparison of Insurance Providers in Maryland

A comparison of key insurance providers in Maryland can help you find the best fit for your needs. Different companies offer varying features and benefits, allowing for a tailored approach to finding the best coverage.

| Insurance Provider | Key Features | Benefits |

|---|---|---|

| State Farm | Wide network of agents, good customer service, diverse coverage options | Established brand, often competitive rates, comprehensive coverage |

| Allstate | Relatively affordable rates, extensive network of agents, wide range of policies | Variety of coverage choices, local presence, potential for discounts |

| Liberty Mutual | Competitive rates, online tools for policy management, customer service options | Convenient online tools, various discounts, potentially lower premiums |

| Geico | Online-focused platform, generally competitive rates, extensive discounts | Ease of online access, potential for discounts based on online interaction, typically competitive rates |

Comparing Insurance Quotes

Source: cloudinary.com

Getting multiple auto insurance quotes is crucial for securing the best possible coverage at the most competitive price. Comparing quotes allows you to see how different insurance providers tailor their rates to various factors. This process empowers you to make an informed decision, aligning your insurance needs with your budget.Analyzing insurance quotes involves more than just price. Careful consideration of coverage details, discounts, and additional benefits offered by each provider is vital.

Understanding the nuances of each policy will help you select the best fit for your driving profile and financial situation.

Sample Quote Comparison

| Driver Profile | Provider A | Provider B | Provider C |

|---|---|---|---|

| Young driver, good record, basic vehicle | $1,200 | $1,150 | $1,300 |

| Experienced driver, accident in last 3 years, luxury vehicle | $1,850 | $1,700 | $1,900 |

| Mature driver, clean record, economical vehicle | $900 | $850 | $950 |

These sample quotes highlight the variability in rates based on factors like age, driving history, and vehicle type. Real-world examples demonstrate how insurance premiums can fluctuate considerably.

Identifying Significant Differences

Comparing quotes involves scrutinizing the specifics of each policy. Focus on the following:

- Premium Amounts: Pay close attention to the overall cost of each policy. A seemingly small difference can accumulate over time.

- Coverage Limits: Ensure liability limits, collision coverage, and comprehensive coverage are adequate for your needs.

- Deductibles: Different deductibles will influence the premium amount. Higher deductibles often lead to lower premiums, but you’ll need to pay a larger amount if you have an accident.

- Discounts: Note any available discounts, such as those for good driving records, safety features, or anti-theft devices.

- Additional Benefits: Some providers offer extras like roadside assistance, rental car coverage, or emergency medical services. Evaluate if these benefits are valuable for your situation.

Understanding Policy Details

Understanding policy details is critical to a well-informed decision. Carefully reviewing each policy’s fine print is vital. Specific details, such as coverage exclusions, and policy limitations should be carefully considered before committing.

Comparing Quotes by Cost and Coverage

A structured approach to comparing quotes streamlines the process. This involves compiling the details of the insurance quotes. A table, for example, can be used to organize the data.

| Insurance Provider | Monthly Premium | Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|---|---|

| Provider A | $150 | $100,000/$300,000 | $1,000 deductible | $500 deductible |

| Provider B | $175 | $250,000/$500,000 | $500 deductible | $1,000 deductible |

This table offers a structured overview, enabling a direct comparison of cost and coverage.

Comparing Discounts

Providers often offer various discounts to incentivize customers. Comparing discounts across providers can help you find the best deals.

| Insurance Provider | Safe Driver Discount | Multi-Policy Discount | Anti-theft Device Discount |

|---|---|---|---|

| Provider A | Yes (5%) | Yes (10%) | Yes (5%) |

| Provider B | Yes (3%) | Yes (15%) | Yes (10%) |

Comparing discounts allows you to identify potential savings. Recognizing and understanding available discounts is essential to getting the best value.

Factors Affecting Insurance Rates: Maryland Auto Insurance Quotes

Source: quoteinspector.com

Maryland auto insurance rates are influenced by a variety of factors, making it crucial for drivers to understand these elements to manage their premiums effectively. A thorough understanding of these variables allows for informed decisions about coverage and potentially lower premiums.Several key aspects significantly impact the cost of auto insurance in Maryland. These include, but are not limited to, driving history, demographics, vehicle characteristics, and even location within the state.

Driving Record

Driving history is a critical factor in determining insurance premiums. A clean driving record, free of accidents and violations, typically results in lower premiums. Conversely, accidents, speeding tickets, and other moving violations can substantially increase premiums. Insurance companies assess the risk associated with each driver based on their past driving behavior. This assessment considers the frequency and severity of past incidents, which significantly influence the premium rates.

Age and Location

Age is a considerable factor in insurance rates. Younger drivers, often considered higher-risk due to inexperience, typically pay higher premiums. Similarly, location within Maryland can affect rates. Areas with higher rates of accidents or traffic incidents often have higher insurance premiums compared to less accident-prone areas.

Vehicle Type

The type of vehicle also plays a role in insurance rates. Certain vehicles, such as sports cars or high-performance models, might have higher premiums due to their perceived higher risk of damage or theft. Insurance companies consider factors like the vehicle’s make, model, and year, as well as its safety features, when determining the appropriate rate.

Driving Behaviors

Specific driving behaviors directly influence insurance premiums. Accidents, speeding tickets, and reckless driving are all factors that contribute to higher premiums. The frequency and severity of these incidents significantly impact the insurance company’s assessment of the driver’s risk profile. For instance, a driver with multiple speeding tickets in a short period might experience a substantial increase in their premiums.

The company’s risk assessment considers the severity of the violation and the history of the driver.

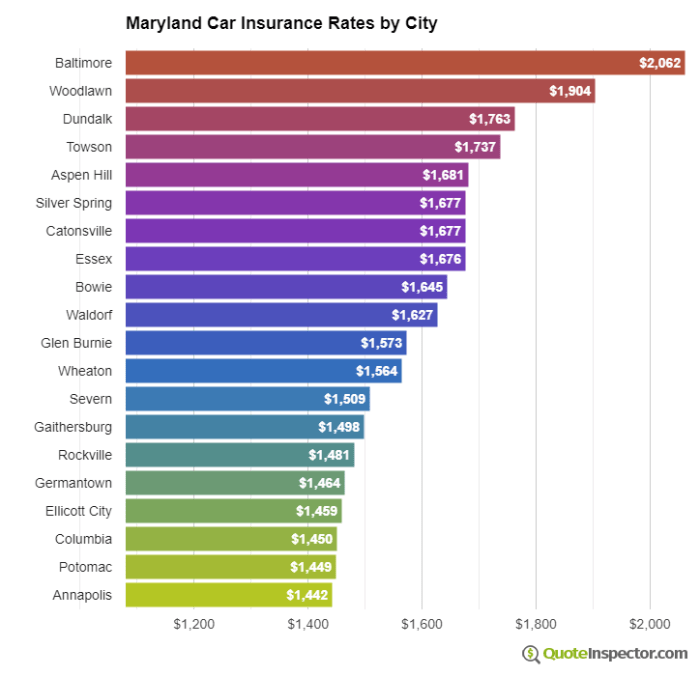

Location-Specific Rate Variations

Insurance rates can vary across different locations within Maryland. Areas with higher crime rates or accident concentrations may have higher premiums. This difference is influenced by the specific risk factors associated with particular regions. Factors like the density of traffic, road conditions, and the presence of high-risk areas all contribute to the variations in insurance rates across the state.

For example, a location known for high-speed chases or accidents might have significantly higher premiums compared to a quiet suburban area.

Ways to Lower Insurance Rates

Several strategies can help lower auto insurance rates in Maryland. These strategies include maintaining a clean driving record, utilizing defensive driving courses, and installing safety features on your vehicle. For example, a driver who completes a defensive driving course may be eligible for a discount on their insurance premium. Similarly, vehicles with advanced safety features, like airbags or anti-lock brakes, may qualify for a reduced rate.

Safe driving habits and a clean record consistently translate to lower premiums.

Impact of a Clean Driving Record

A clean driving record is a strong indicator of a lower risk for insurance companies. Drivers with no accidents or violations often receive lower premiums. This demonstrates that responsible driving habits can significantly reduce insurance costs. A consistent record of safe driving significantly reduces the premium.

Navigating the Quote Process

Securing the best auto insurance quote in Maryland involves a methodical approach. Understanding the steps involved and common pitfalls can significantly impact your final premium. This section details the process, from initial inquiry to policy signing, to help you make informed decisions.

Typical Steps in Obtaining Quotes, Maryland auto insurance quotes

The process for obtaining Maryland auto insurance quotes typically involves several key steps. First, you’ll need to gather the necessary information about your vehicle and driving history. Then, you’ll compare quotes from various insurers, carefully considering factors such as coverage options and premiums. Finally, you’ll select the policy that best suits your needs and review the documents thoroughly before signing.

This structured approach will assist you in making an educated choice and obtaining the most appropriate coverage.

Common Mistakes to Avoid

Comparing auto insurance quotes can be straightforward, yet some common mistakes can lead to higher premiums or inadequate coverage. One frequent error is neglecting to compare comprehensive quotes from multiple insurers. Another is not adequately understanding the nuances of different coverage options. Finally, failing to review the policy documents before signing can lead to unexpected issues later on.

By avoiding these pitfalls, you can secure a more cost-effective and comprehensive policy.

Essential Information Needed for Quotes

To obtain accurate and competitive quotes, you need to provide specific details. This includes vehicle information like the year, make, model, and VIN (Vehicle Identification Number). Driver information, such as age, driving history (including any accidents or violations), and location of primary residence, is also crucial. Providing this detailed information accurately will ensure the insurer has the correct data to assess your risk profile and provide a tailored quote.

Reviewing Policy Documents Before Signing

Before committing to a policy, thoroughly review all documents. This includes the policy summary, the declarations page, and any endorsements. Understanding the coverage limits, deductibles, and exclusions is paramount. This step ensures that the policy aligns with your needs and expectations. Carefully reading and understanding the terms of your insurance policy will save you potential headaches and ensure you have appropriate protection.

Step-by-Step Guide to Comparing Quotes Online

Comparing auto insurance quotes online can be a convenient process. Here’s a step-by-step guide to help you navigate the process:

- Gather Essential Information: Collect your vehicle’s details (year, make, model, VIN), driver information (age, driving history, location), and any other pertinent details requested by the insurance providers.

- Access Online Quote Platforms: Utilize online comparison tools or directly visit the websites of various Maryland auto insurance companies. These platforms allow you to input your details and receive quotes from different insurers.

- Compare Quotes: Carefully examine the quotes provided by various insurers. Compare premiums, coverage options, and any additional fees. Pay close attention to deductibles, coverage limits, and any hidden costs.

- Review Policy Documents: Before committing to a quote, carefully read and understand the policy documents, including the policy summary, declarations page, and any endorsements. Ensure the coverage aligns with your needs.

- Choose the Best Policy: Select the policy that best fits your budget and desired coverage. Compare quotes from different companies and choose the most suitable option.

Insurance Providers in Maryland

Source: autoinsurance.org

Choosing the right auto insurance provider in Maryland is crucial for securing financial protection and peace of mind. Understanding the various options available and their specific strengths and weaknesses empowers consumers to make informed decisions. This section explores popular providers, their services, reputations, and key distinctions.

Popular Insurance Providers in Maryland

Several well-established and reputable insurance providers serve the Maryland market. These companies offer varying levels of service and coverage, and understanding these differences is vital for selecting the best fit.

- State Farm: A nationwide giant, State Farm enjoys a strong presence in Maryland. Known for its extensive network of agents, State Farm provides personalized service and a wide range of insurance products, including auto, home, and life insurance. Their reputation often centers on their extensive customer service infrastructure, although the speed and efficiency of online interactions can vary.

- Liberty Mutual: Liberty Mutual is another major player in the Maryland insurance market. The company is known for its competitive rates and comprehensive coverage options. Their online portals are user-friendly, allowing customers to manage policies and claims effectively. Liberty Mutual has a generally positive reputation for both customer service and policy transparency.

- Geico: Geico is a popular choice in Maryland due to its often-competitive pricing, especially for young drivers or those with a clean driving record. Their online platform is widely praised for its ease of use, allowing for quick quote comparisons and policy management. Geico’s reputation often revolves around their streamlined online processes and competitive rates.

- Progressive: Progressive is a prominent name in the Maryland market, recognized for its innovative approach to insurance. Their focus on technology is evident in their online tools and customer support systems. They frequently feature discounts and promotions, contributing to their appeal among consumers. Customer satisfaction scores often reflect a blend of positive and negative experiences.

- Allstate: Allstate, a national provider, has a significant presence in Maryland. They offer a wide array of insurance options and services. While they often feature a large network of agents, online resources are generally well-regarded for their ease of use.

Comparison of Insurance Providers in Maryland

To facilitate a clearer understanding of the various insurance providers, a comparison table is provided. This table offers a concise overview of their customer service approaches and online platforms.

| Insurance Provider | Customer Service | Online Platform |

|---|---|---|

| State Farm | Extensive agent network, potentially longer wait times for online support | Generally user-friendly, with room for improvement in responsiveness |

| Liberty Mutual | Positive reviews, effective online support | Well-designed online portal, efficient policy management |

| Geico | Generally responsive, but reviews vary | Highly regarded for ease of use, quick quotes |

| Progressive | Mixed reviews, some reports of difficulty accessing support | Innovative online tools, but customer service access may vary |

| Allstate | Large network of agents, online support generally well-regarded | User-friendly online portal, effective for policy management |

National vs. Regional Insurance Providers

The distinction between national and regional providers often revolves around their service area and customer base. National providers, like State Farm and Allstate, typically offer broader coverage across the country. This translates into established infrastructure, but potentially less localized knowledge of specific Maryland regulations or market conditions. Regional providers, while not as widely recognized nationally, may offer a more tailored understanding of the local market.

This could result in rates that better align with Maryland’s unique characteristics.

Understanding Coverage Options

Choosing the right auto insurance coverage is crucial for protecting yourself and your assets in Maryland. Understanding the different types of coverage available and their limitations is key to making an informed decision. This section delves into the specifics of various coverages, their benefits, and their importance in safeguarding your financial well-being.

Types of Auto Insurance Coverage

Maryland auto insurance policies typically include several coverage options. These options provide varying levels of protection against different risks associated with car ownership. Understanding each coverage type is essential for selecting a policy that aligns with your needs and budget.

- Liability Coverage: This coverage protects you if you are at fault for an accident and cause damage to another person’s property or injury to another person. It typically covers the cost of damages and medical expenses for the other party. The importance of liability coverage is paramount, as it legally obligates you to compensate others for any damages you cause.

For instance, if you cause a car accident resulting in property damage and medical bills for the other driver, your liability coverage will help manage these costs. A standard policy may include limits, such as $100,000 per person and $300,000 per accident. Knowing these limits is vital for understanding your financial responsibility.

- Collision Coverage: This coverage pays for damages to your vehicle regardless of who is at fault. It is essential for protecting your investment in your vehicle. This coverage kicks in if your car is damaged in an accident, regardless of who was responsible. For example, if you are involved in a collision with another driver and your car is damaged, collision coverage would cover repairs.

- Comprehensive Coverage: This coverage pays for damages to your vehicle that aren’t caused by a collision. This includes events like vandalism, theft, fire, hail, or weather damage. Comprehensive coverage is valuable because it protects against unforeseen events that could significantly impact your vehicle’s value. For example, if your car is stolen or damaged by a storm, comprehensive coverage would assist in restoring your vehicle.

- Uninsured/Underinsured Motorist Coverage: This coverage is crucial if you are involved in an accident with a driver who doesn’t have insurance or whose insurance limits are insufficient to cover the damages. This coverage protects you from financial losses if you’re injured or your vehicle is damaged by an uninsured or underinsured driver.

Understanding Coverage Limitations

It’s vital to understand the limitations of each coverage type. For instance, liability coverage may have limits on the amount it will pay. Collision and comprehensive coverage might have deductibles, which are the amounts you pay out-of-pocket before the insurance company steps in. These limitations can significantly impact your financial responsibility if an accident or damage occurs.

Careful consideration of the limits and deductibles of each coverage is crucial.

Cost of Coverage Options

The cost of various coverage options varies based on several factors. Factors include your driving record, vehicle type, location, and chosen coverage limits. The following table provides a general overview of potential costs, but these are estimates only, and individual costs can differ significantly.

| Coverage Type | Description | Estimated Cost Range (per year) |

|---|---|---|

| Liability | Covers damages to others’ property or injuries. | $100 – $500+ |

| Collision | Covers damage to your vehicle in a collision, regardless of fault. | $100 – $300+ |

| Comprehensive | Covers damage to your vehicle from events other than collisions (e.g., theft, vandalism). | $50 – $200+ |

| Uninsured/Underinsured Motorist | Protects you if involved in an accident with an uninsured/underinsured driver. | $50 – $150+ |

Importance of Adequate Coverage

Having adequate auto insurance coverage is essential for drivers in Maryland. It provides a financial safety net in case of accidents or damages, protecting you from significant financial burdens. A comprehensive policy offers the best protection against various risks, ensuring your financial well-being in the event of unforeseen circumstances. For instance, adequate coverage can help prevent you from facing significant out-of-pocket expenses following an accident or other damaging events.

End of Discussion

Source: baldersoninsurance.com

In conclusion, securing the right Maryland auto insurance quotes involves careful consideration of various factors and providers. This guide has provided a comprehensive overview of the market, from understanding coverage options to navigating the quote process. By comparing quotes, analyzing coverage details, and understanding the factors influencing rates, you can make a smart choice that balances affordability and adequate protection.

Remember to review policy documents thoroughly before signing and consider your specific needs and circumstances. We hope this guide has been helpful in your quest for the best possible Maryland auto insurance quotes.

Frequently Asked Questions

What are the typical steps involved in getting auto insurance quotes in Maryland?

Gathering information about your vehicle, driver history, and desired coverage is the first step. Next, compare quotes from different providers, considering costs and coverage options. Finally, review policy documents before committing to a plan.

How can I potentially lower my auto insurance rates in Maryland?

Maintaining a clean driving record, selecting a safe vehicle, and considering available discounts can significantly reduce your insurance premiums.

What are some common mistakes to avoid when comparing quotes?

Failing to compare all relevant aspects of coverage and neglecting to review policy details before signing can be costly mistakes. Rushing the process without adequate consideration can lead to an unsuitable policy.

What are some common factors that influence auto insurance premiums in Maryland?

Factors such as your driving record, vehicle type, age, and location can significantly influence your insurance premiums. Prior accidents and speeding tickets will affect your rates, as will the type of vehicle you drive.